What to Do BEFORE an Auto Accident

Many of us are concerned what to do when and after an accident happens, as we should be, but what we do before an accident even happens is just as important, if not more. Car accidents can be a very difficult, frustrating, and challenging experience, so we need to be proactive about making sure we are prepared and protected in the event an accident does happen.

Three very important and simple things you can do to protect yourself before an accident is to:

- Check your auto insurance policy to make sure you have Uninsured/Underinsured Motorist Coverage; and

- Install a dash camera in your vehicle. Having a dash camera in your vehicle will easily resolve any liability issues, if liability is being disputed.

- Print out our free Borkovic Law Group Checklist, of what to do before and after an accident, and always keep it handy in your car. Click here to download, save, and print.

Uninsured/Underinsured Motorist Coverage (What Is That?)

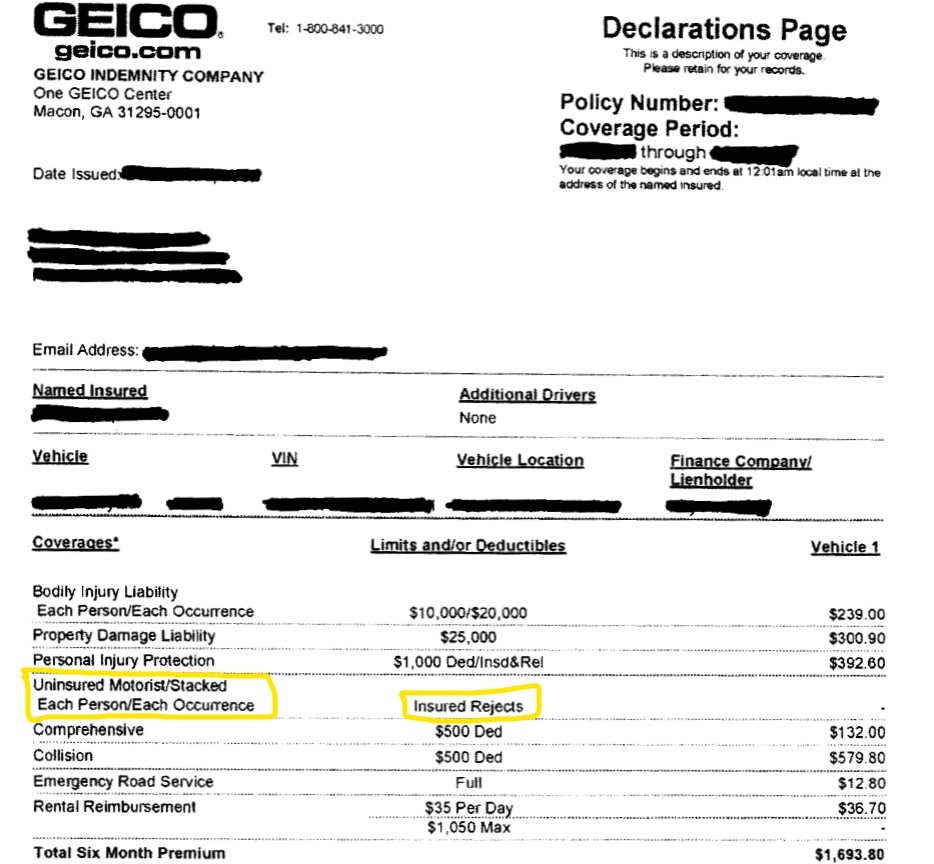

STOP what you are doing right now. As you are reading this article, pull up your auto insurance policy either on your phone or computer, and check what kind of coverage you have on your policy. If your Uninsured/Underinsured section says “none” or “rejected,” this means that you are NOT carrying valuable insurance that protects you and your family in the event of a car accident. When you pull up your policy, look for an option that says “c

If your insurance policy looks similar to one above, where there is NO Uninsured/Underinsured Motorist coverage on your policy, IMMEDIATELY call your local insurance agent today and request for this coverage to be added to your policy, as much as you can afford.

In short, Uninsured/Underinsured Motorist is coverage you carry to protect yourself in an accident, in case you get hit by a driver that is not insured, or does not have enough insurance. In other words, the driver that hit you could have no Bodily Injury coverage at all, or not have enough Bodily Injury coverage. Bodily Injury is a liability coverage, that provides coverage for OTHER people you may injure as result of your own liability from an accident. You may be surprised to find out that Bodily Injury Liability coverage is an OPTIONAL coverage to have on your auto policy, and it is NOT a requirement in the state of Florida. According to reviews.com, Florida has the highest rate of uninsured drivers in our nation – 26.7% of all Floridian drivers are driving uninsured! Meaning they do not carry any Uninsured/Underinsured coverage nor any Bodily Injury Liability coverage.

You cannot rely that the other driver that hits you will have insurance for your injuries, especially in Florida where you have a 1 out of 4 chance of that happening. What you CAN do, is make sure you protect yourself and your family by adding as much Uninsured/Underinsured Motorist coverage that you can afford on your auto policy. Unfortunately, we have had many past experiences where a client presents to our office injured after an accident, but the person that hit them did not have liability insurance, and neither did the client have Uninsured/Underinsured Motorist coverage on their policy. The last thing we want to do is turn you away when we find out there is no coverage applicable for your case. Your attorneys at Borkovic Law Group would be more than happy to review your auto policy with you free of charge, to make sure you and your family will be protected in the event of an accident. Call us today at (727) 798-5291.